October 24, 2022

Data Breach: Who Becomes Responsible After

A data breach can have devastating consequences for businesses and individuals alike. In the aftermath of a breach, it’s often unclear who is responsible for taking action to mitigate the damage or who is at fault for the economic damage caused by the breach. This can lead to confusion and conflict, which can further hamper efforts to resolve the issue. To prevent these problems, it’s important to have a clear understanding of who is responsible after a data breach occurs.

Customers’ Responsibility

In the wake of a data breach, it’s common for businesses to place the blame on their customers. However, there are several reasons why this is not always fair or accurate. First of all, it’s often the case that businesses don’t take proper security precautions to protect their customers’ data. This means that even if customers are careful with their own information, their data might still be at risk.

Additionally, many data breaches are the result of malicious attacks by hackers, which are beyond the control of individual customers. As such, it’s important to remember that data breaches can happen to anyone, regardless of how careful they are. Because of these factors, it’s often unfair and inaccurate to hold customers responsible for data breaches that are beyond their control.

The Responsibility of Financial Institutions

After a data breach, it’s common for consumers to point the finger at banks and card issuers. After all, these financial institutions hold all of our personal information and financial data. However, it’s important to understand that banks are not always responsible after a breach. While financial institutions often help their customers recover from their losses and work to prevent further damage to their credit, these same companies may also sue the company that experienced the data breach since their security systems failed to prevent the attack. While banks are involved in the process, they’re not solely responsible after a data breach.

How Companies Are Responsible

In the era of digital information, data breaches have become increasingly common. Large companies are particularly vulnerable to attacks since they often hold sensitive information about millions of customers. Given the potential consequences of a data breach, many people believe that companies have a responsibility to protect their customers’ information. However, companies often argue that they can only do so much to prevent cyberattacks, so customers should also be responsible for their data protection.

After a data breach, a business should typically inform its clients, review its security systems, and process claims for monetary damage if necessary. It might also need to employ a crisis response consultant to fix its security processes or pay information breach fines. A 2014 Cost of Information Breach Research study revealed that the average expense for each lost or stolen record was $201, while the overall typical expense paid by organizations was $5.9 million.

How to Avoid Data Breaches

Ultimately, the best way to avoid being held responsible for a data breach is by avoiding the breach in the first place. Many data breaches occur because the victim isn’t implementing good security practices. Luckily, Proshred® Houston has a few information security tips that could protect you from harmful data breaches.

Recommended Information Security Practices

- Promote a culture of security in your office with a strict information security policy that is implemented by the entire company, including higher-ups

- Hire a full-time information security manager

- Only keep information that you need to operate your business or to stay compliant with federal and state regulations

- Hire a paper shredding company to destroy sensitive documents

- Offer routine security training for your employees

- Limit employee access to sensitive information with only authorized employees having access to confidential documents

- Implement accounting procedures that safeguard financial information

- Execute a clean desk policy, so sensitive information is never left in the open

- Immediately report security breaches

- Install security software on every computer and electronic device that holds sensitive information

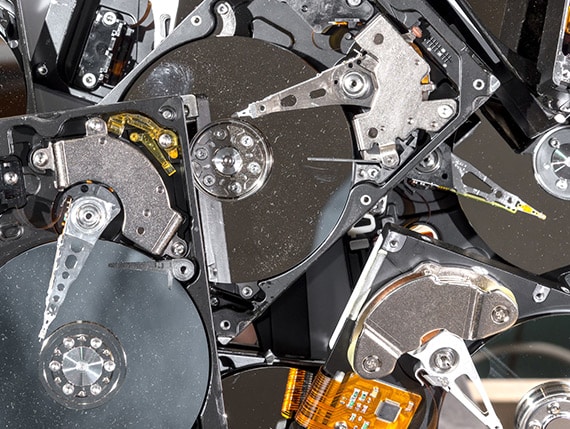

- Use a hard drive destruction service to safely dispose of old electronic devices

Protect Your Company With Proshred® Houston

Ultimately, everyone involved in a data breach needs to take responsibility for preventing future attacks. As a company, it’s important to take data security seriously in order to avoid data breaches entirely. By following some of our tips and working with a professional paper shredding company like Proshred® Houston, you can help protect your company from becoming the victim of a devastating data breach.

For more information about our paper shredding and hard drive destruction services, contact Proshred® Houston today. We’ll be happy to answer any questions you have about our services.